Summary

- Shale being promoted as an economic miracle

- Claimed to have reduced US carbon emissions

- In reality caused by the economic crisis

- Demand drop reduced US coal and oil use

- Similar falls in UK and other countries

- Coal and oil redirected to China etc.

- Not practical for US gas so prices low

- Gas production temporarily continued to grow

- Due to variety of slow to change factors

- Cannot continue as companies loosing money

- Shale gas is expensive, dirty and short term

The otherwise completely ineffectual UN Climate Conference, for an 18th year of fiddling while Rome burns, which is fittingly being hosted this December in Doha, Quatar, the largest per capita carbon emitter in the world, has provided the excuse for another round of pro-fracking propaganda. A perfect example of this would be the recent article in the Guardian titled Doha 2012: US claims ‘enormous’ efforts to cut carbon emissions which contains the absurd statement that “Greenhouse gas emissions from the US have fallen sharply in recent years, owing to the replacement of coal-fired power generation by gas in the US, following its widespread adoption of shale gas”. This narative has been around for several months, but it is now getting much wider exposure with such publications such as New Scientist and the Spectator pushing the idea. While there have been some weak attempts to inject some sanity into the discourse, in particular by the Tyndall Centre for Climate Change Research and Greenpeace, everyone has really been missing the point. We have reported before on this issue (particularly in relation to the hyping of low natural gas prices in the US) but it clearly requires more work to bust this myth.

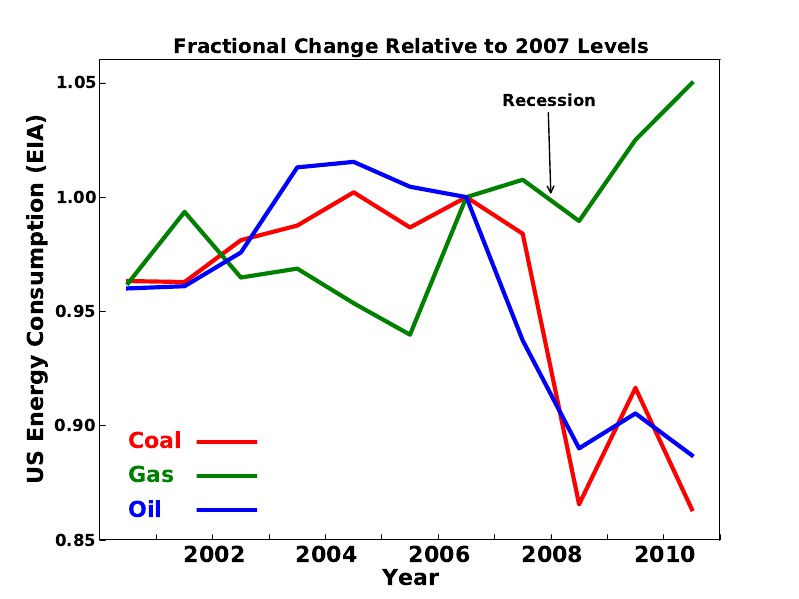

Fractional Changes in US Fossil Fuel Consumption by Type, Relative to 2007 Levels (Data from EIA) – Note the y-axis scale does not start at zero, coal and oil drop about 10 percent and gas rises about 5 percent

Back in the real world there are some rather inconveinent facts standing in the way of this story. The biggest show stopper is that the drop in US emissions has nothing whatsoever to do with shale gas. As can be seen clearly from the graph of US fossil fuel consumption above that a 10 percent drop in US oil and coal consumption, which are responsible for the bulk of US emissions, occured suddenly in 2009 just after the 2008 credit crunch. Subsequently, from 2010 onwards, US natural gas consumption has risen slightly (by about 5 percent over 2 years) but since this happens after the fall in oil and coal consumption and not before, it cannot be the cause of the fall. To anyone who is not an economist the explaination for all this is obvious, the recession following the credit crunch produced a drop in demand for energy which reduced consumption. In fact similar falls in emissions occurred in the UK and other first world countries following the economic downturn. For instance this article in the Guardian states “Government estimates released on Tuesday showed greenhouse gas emissions fell by 8.7% from 2008 to 2009, the biggest drop since records began in 1990” and goes on to say that “The unexpectedly deep slump in emissions mirrors the fall in industrial output in the recession, with high-emitting sectors including construction and transport hit particularly hard”. Attributing exactly the same events occurring in the US to shale gas make no sense at all.

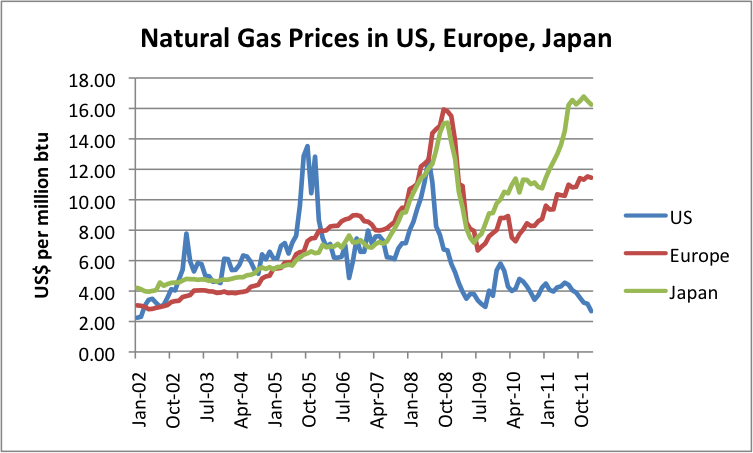

Natural gas prices in US, Europe and Japan (Data from World Bank)

A secondary question is why US gas comsumption has risen slightly, given that overall energy demand has fallen. The answer is slightly more complicated but not really to the extent that excuses the present gross misunderstandings of the situation. Examination of the graph of natural gas prices above shows that prices fell everywhere following the recession but rebounded very quickly in Japan, somewhat more slowly in Europe and not at all in the US. The differences in the natural gas supplies of these regions are more than enough of a clue to what is going on. Japan produces almost no natural gas and must import pretty much all that it uses, whereas the US produces almost all of its own natural gas. Europe falls somewhere between these two extremes. The US is therefore extremely isolated from the world natural gas market (such as it is) and that cannot change quickly since it would require building large numbers of highly specialised tankers and liquification/gasification plants overnight. Any drop in demand cannot easily be diverted elsewhere and so will result in low prices. On the other hand Japan is totally linked into the world market and any drop in demand there will just result in the cargoes of liquified natural gas (LNG) tankers being rerouted to countries like China, provided demand remains strong there. Europe is intermediate between Japan and the US in both regards. The only thing left to explain is the slight increase in US gas production in the face of these low prices.

Shale gas production in the US by area

The issue of rising production (seen in the graph above) is also slightly complicated but still possible to understand. Shale gas producers like Chesapeake Energy are in financial difficulties because of the low gas prices, which are well below the production cost of shale gas. However, those difficulties provide no incentive to shut down production from wells they have already spent the money to drill, since some revenue is better than none when you are short of cash. Also, gas wells tend to produce at least some liquids and oil wells at least some gas, which means that with oil prices sky high a lot of gas will be produced as a byproduct just to get at the liquids. Finally companies often have contractual obligations to drill wells by a certain date or loose rights to leases. This combination of factors has temporarily pushed up gas production even in the face of low prices. This situation cannot continue indefinitely though and prices must rise back above production costs. In the meantime what has actually happened as far as the planet is concerned is that oil and coal previously burned by the US has been burned by other countries (mainly China) and US consumption of natural gas has increased slightly (due to the unsustainably low gas prices in the US). Far from the decrease that is being touted, this is actually a net increase in emissions. Add in fugitive emissions of methane from shale gas production and it begins to look very bad for the climate. The self-serving retoric of the unconventional gas industry aside, the reality is that it is expensive, dirty and very short term.